First Horizon

Based in Memphis, with a regional footprint extending across 12 states in the Southeast, First Horizon Bank was Mindgruve’s most important client. I was lucky enough to work on some of their most daunting campaigns.

Website overhaul, byzantine deposit campaigns, creative content for a new podcast.

Years

2022–24

Services

UX Concepting

Omnichannel Storytelling

Client Presentations

Client

First Horizon Bank

Awards

AVA Digital (Gold)

Overview

Capital and counsel.

First Horizon was our premier Tier A client. They signed a multimillion dollar retainer with Mindgruve and enlisted our services in everything from paid search to banner ads to complex media plans. While the $32 billion in assets under management they oversee is diminutive compared to behemoths like JP Morgan, the breadth of their services still demanded a marketing output layered with creative assets that we coordinated across interweaving channels.

Staid and corporate as banking advertising can be, First Horizon often proved to be a tumultuous account, largely because throughout 2022–24 we worked to preserve — and enhance — their brand presence after their merger with TD Ameritrade blew up following the collapse of Silicon Valley Bank and the devaluation of regional banks, which were something of a casualty of the Fed’s campaign against inflation. Through it all, however, First Horizon remained committed to providing financial insights to the consumers who trusted them with their money and their dreams.

Website Redesign.

In July 2020, First Horizon merged with IberiaBank, opening them to new markets and impelling them to overhaul their website to create a more sophisticated experience for a suite of new users. They wanted a new site to serve as an educational resource, giving their clients budgeting tips, financial tools, and information on topics like managing debt or buying a home or saving for retirement. So our job, starting in 2022, was to meld artistry with functionality to improve the navigation, set up more effective lead gen funnels, clean up the code (using Semantic HTML5), develop against WCAG 2.1, and add a stronger analytics framework to ensure the site was accessible to all visitors.

Target Audience

Current First Horizon clients.

Retail and commercial markets.

Retail / Wealth

Affluent consumers (>$1mm investable assets). Small businesses (<$5mm annual sales).

Commercial

Enterprises of $25–$500 million in annual sales. Manufacturing, professional services, healthcare.

Designing by writing.

Enter the Death Star.

You know those crime thrillers where the detectives wrap a spider web of thread around thumbtacks pressed into photos of suspects on a bulletin-board? That’s what it felt like to write this site. The scope of the web redesign was so ambitious that the sitemap looked like the Death Star. In total, I was responsible for mapping out 85+ individual pages into a seamless flow of information.

As I stared at every button on every page, I asked myself:

- Who is the user?

- What’s he looking for on this page?

- What will he be looking for on the next page?

- How can I simplify the process for him?

Sitemap.

See that periodic-table-of-elements monstrosity over there, next to this block of text? That’s the sitemap. Click on it, and you’ll notice that it’s comprised of seven sections. Each section is about the size of a typical web project. Here’s a list of all the sections:

- Personal Banking

- Small Business Banking

- Commercial Banking

- Advisors

- Footer

- Learning Center

- Tools & Support

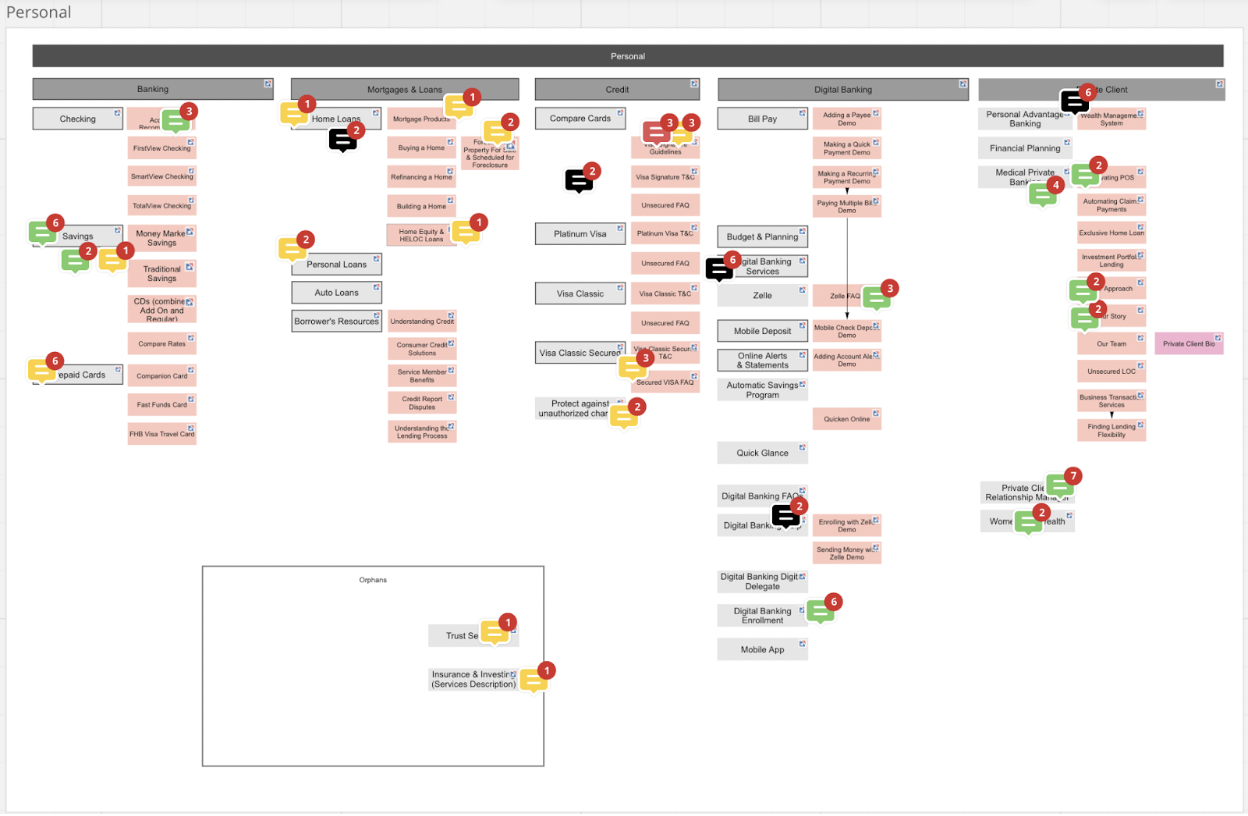

Sub-Sitemap.

The copywriters divvied up the sections. I focused on ”Personal Banking,” which came with its own multicellular sitemap. This subsection was divided into five deeper subsections:

- Banking

- Mortgages & Loans

- Credit

- Digital Banking

- Private Client

See all those gray and pink rectangles unfurling below the subsections? Those are individual webpages. I wrote them so that they felt effortlessly integrated with each other and the rest of the site.

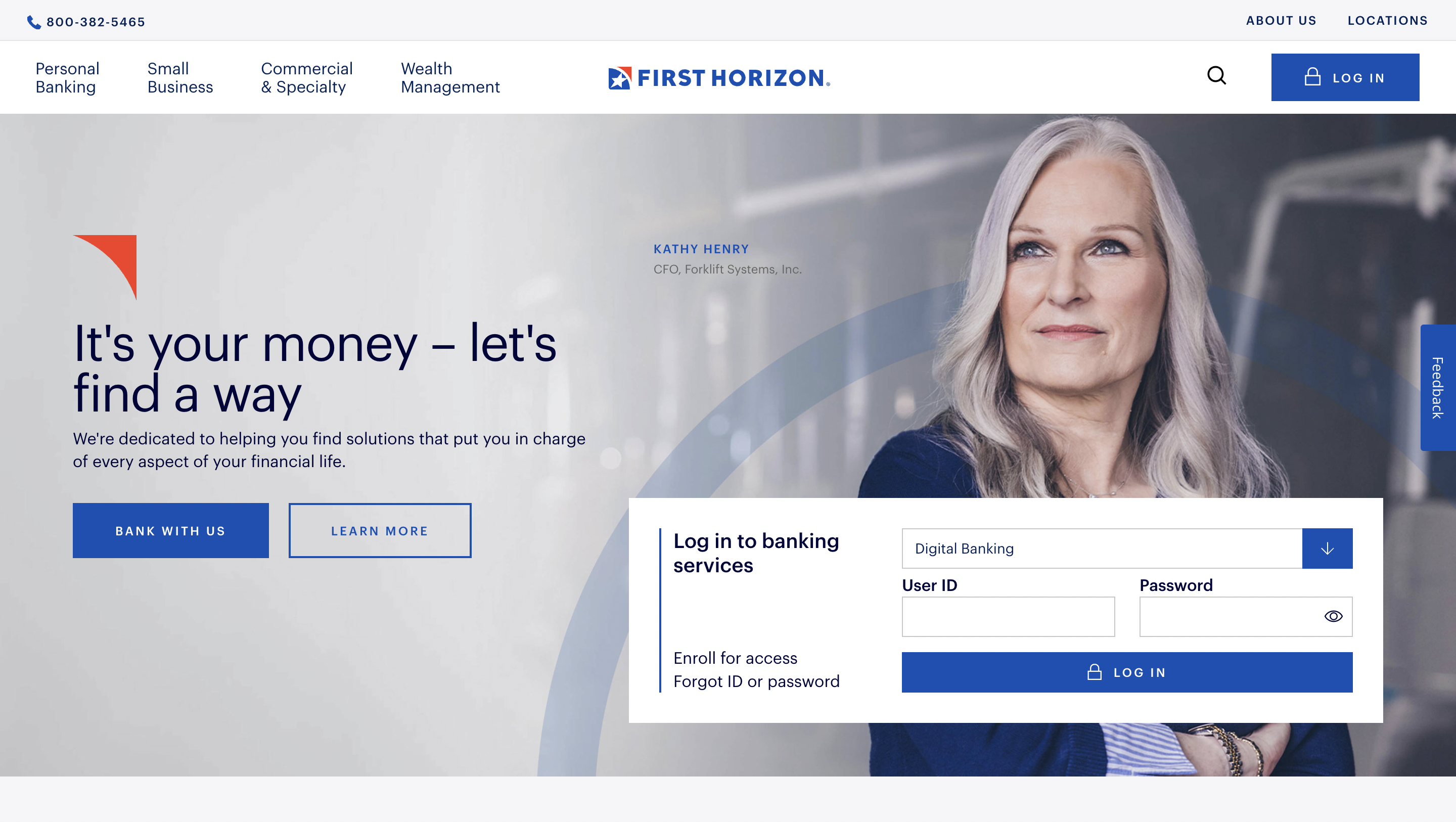

- HomepageAfter we assembled a bird’s-eye view of the site’s structure, we wrote the copy doc. So here’s an example of how I designed by writing. Let’s imagine that the user lands on the homepage. This is what she sees.

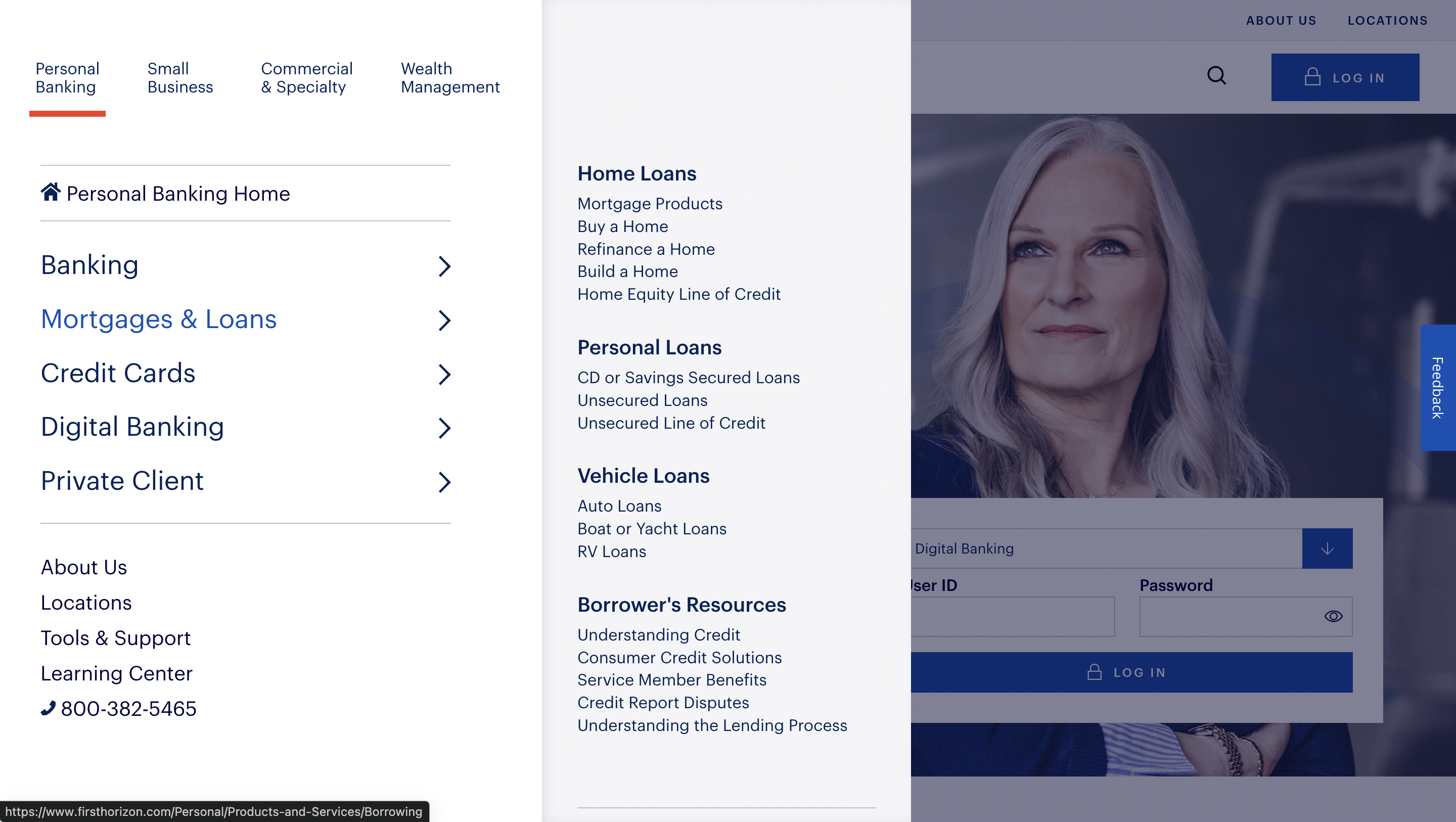

- Personal BankingNow let’s say she clicks “Personal Banking.” User research indicated that clients who have a personal banking relationship with First Horizon are interested in finding information about banking, mortgages and loans, credit cards, digital banking, and private client resources. So we inserted those options into the sidebar that appears under “Personal Banking.”

- Mortgages and LoansImagine that the user clicks “Mortgages and Loans.” Now a deeper sidebar appears, this one broken into four even more granular resources: “Home Loans,” “Personal Loans,” “Vehicle Loans,” and “Borrower’s Resources.”

- Home LoansThis is the page that the user sees once she clicks “Home Loans.” Friendly visuals and headlines written in the brand voice minimize her cognitive load. The first prominent button on this module, “Get Started,” links users to an inquiry page where they can buy, refinance, or build a home.

- Mortgage ResourcesThe button next to “Get Started” is “Find A Loan Originator.” We coded that button with an anchor link that drops users down the page to a module that helps locate the nearest loan originator within 20 miles of where the user lives. Throughout the page, the user encounters mortgage calculators and other resources that help untangle the process of applying for a home loan.

A wealth of options.

Clicking from the homepage into a module that lets you find a loan originator was just one of the countless user journeys within this site. We often felt as if we were constructing the most labyrinthine slip-’n-slide in the biggest waterpark in the universe. But it was all worth it. We wrote the site in the signature style of the brand voice: friendly and approachable. The UX felt fluid, connecting customers to their private accounts, financial literacy resources, bankers who could help them with everything from investing in money market accounts to setting up digital fraud protections. The client loved the refreshed site, which yielded results: Faster load times, an uptick in pages per session, and a dramatic spike in leads. Check out the numbers below.

27%

Faster Page Load Times

6.5%

Pages Per Session

560%

Increase In Leads

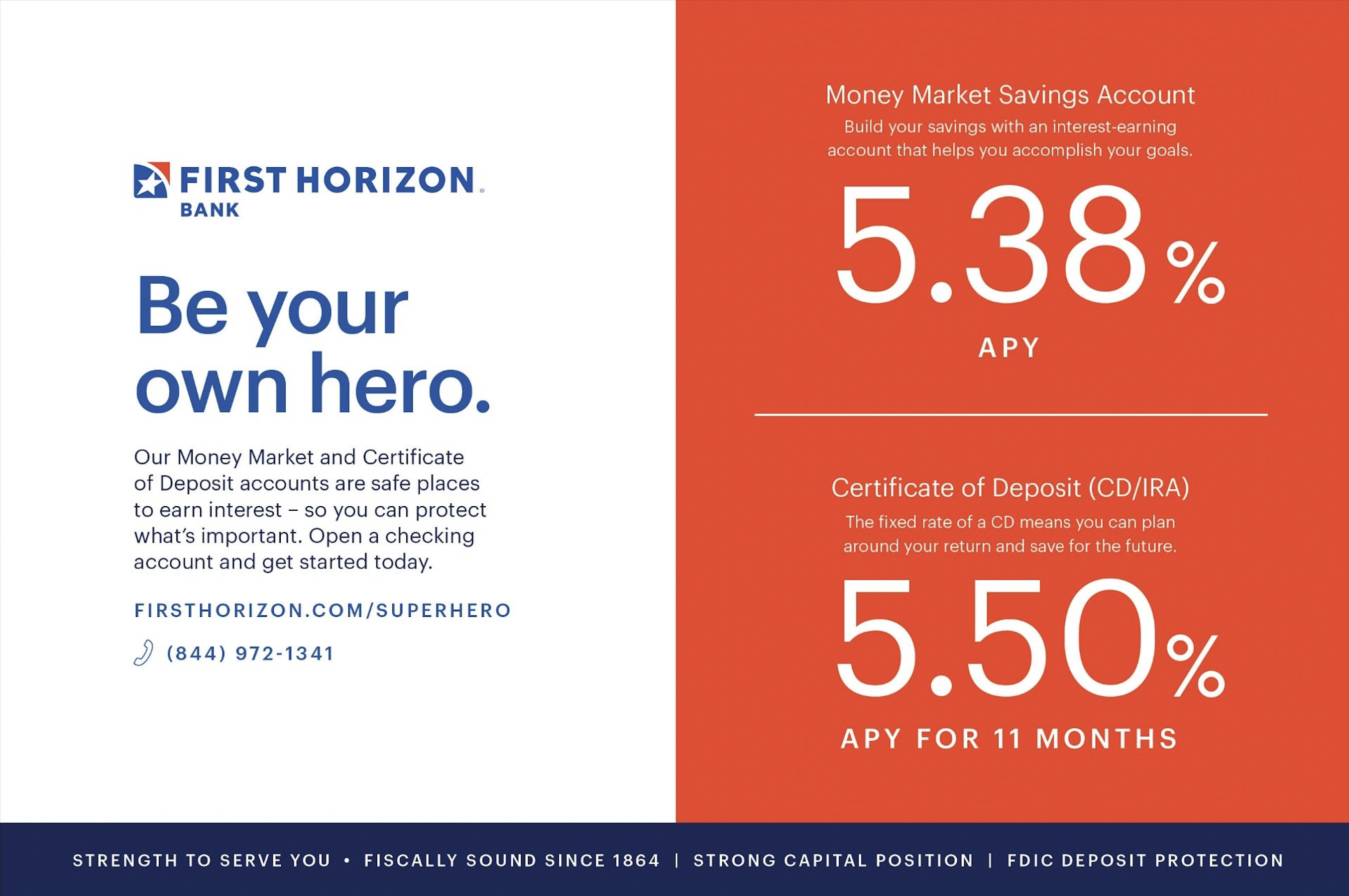

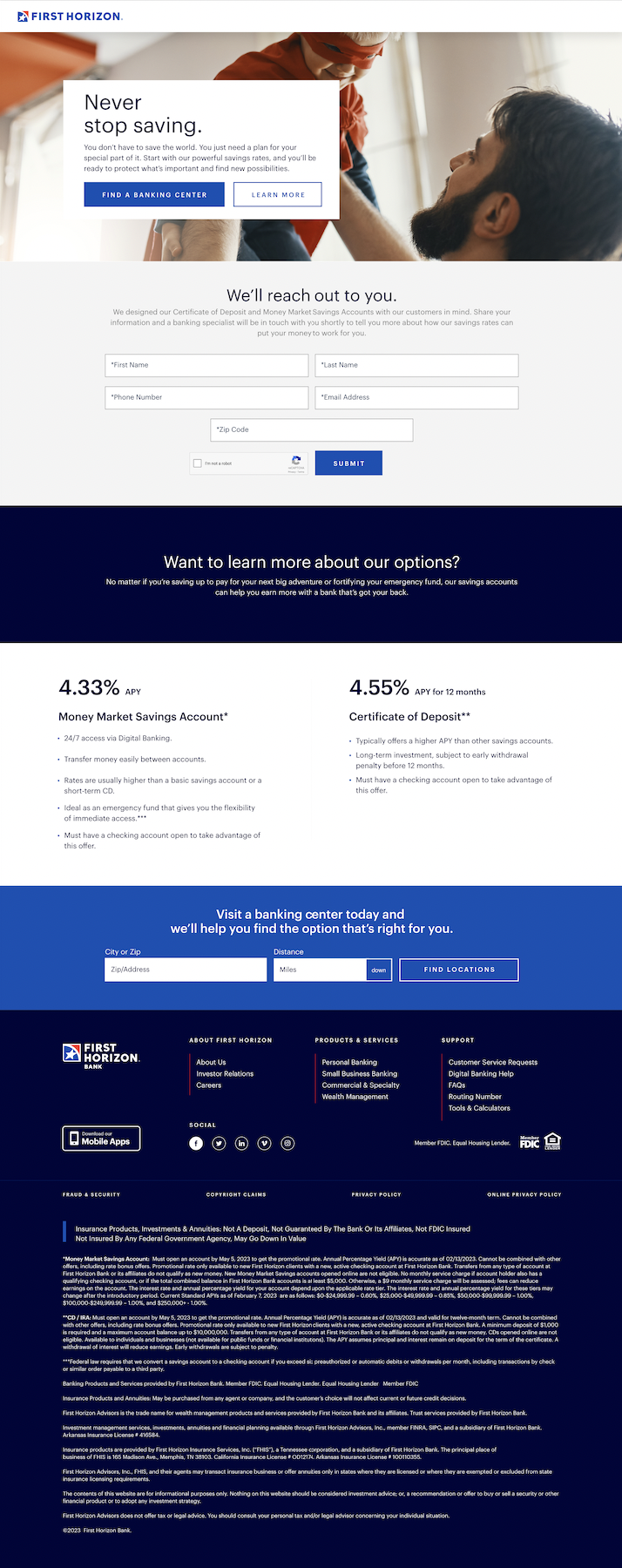

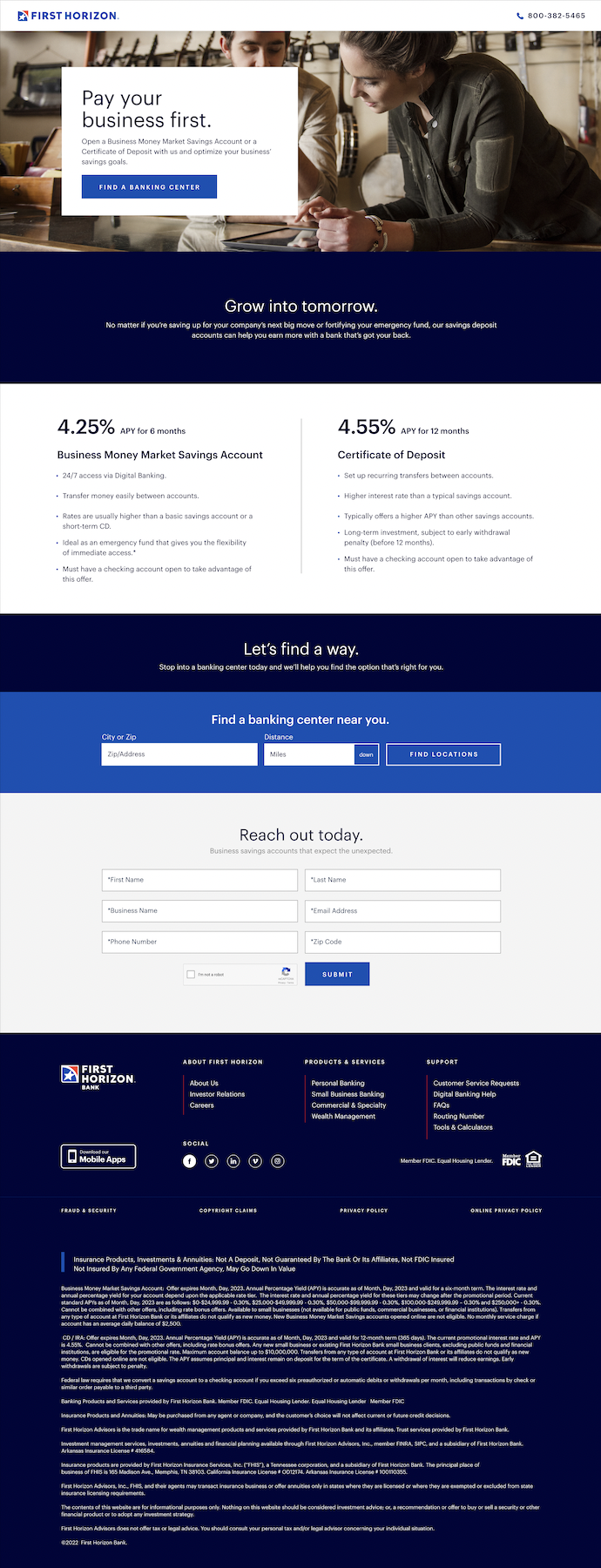

Deposit Campaigns.

The Federal Reserve began hiking interest rates in the spring of 2022, but it wasn’t until a year later, in March 2023, that Silicon Valley Bank (SVB) imploded. First Republic Bank and Signature Bank failed that month, too. Regulators seized all three banks. Pundits clamored about systemic contagion. And TD Ameritrade called off its proposed merger with First Horizon. Investors suddenly viewed regional banks as uninvestable — an announcement that caused First Horizon’s stock price to plummet 61% between February–May 2023. Witnessing outflows in their deposits, First Horizon was worried that they’d experience a bank run unless they advertised their rates.

So they enlisted Mindgruve to create a series of campaigns intended to sell two banking products: certificates of deposit and money market savings accounts. The goal was to increase deposits and roll them into loans. The products were straightforward. Even our audiences groups weren’t all that complex.

Mass Affluent

Middle-aged consumers with a portfolio of over $100,000 in investable assets.

Emerging Affluent

Younger families who have saved up a portfolio worth at least $100,000.

Small Business Clients

$2–10 million in annual sales. Manufacturing, professional services, healthcare, wholesale trade.

Checkers becomes chess.

Two products, three audiences — simple enough. Except here’s where it gets tricky: First Horizon tasked us with developing 13 individual pieces of creative per product per audience. All of which added up to an asteroid belt of over 90 miniature projects across multiple channels. Hover over the work below, which we developed for each audience.

⸺ 3 emails.

⸺ 4 direct mailers.

⸺ Facebook ads.

⸺ Thank you page.

⸺ Landing page.

⸺ Display ads.

⸺ Paid search.

⸺ ATM screen.

The billion-dollar campaign.

I know what you’re thinking — ’All that stuff looks the same.’ Fair. But the challenge of this campaign wasn’t the variety of the work. Instead, it was keeping the messaging consistent for so many assets targeting so many audience groups across so many channels. And it produced results. Deposits increased $1.6 billion QoQ. Customers opened 19,000 new deposit accounts in 3Q23 alone. The deposit growth of 2.4% outpaced the industry growth average of 0.3%. In all, our work helped First Horizon maintain stability through the volatility that plagued the markets in 2023.

$1.6 billion

Increased Deposits (QoQ)

Bucket List.

In the summer of 2022, First Horizon told us that their user research revealed that a broad swath of their client base did not expect to ever retire. No wonder that any retirement-themed advertising that First Horizon pushed failed to resonate in the market. They did notice, though, that their consumers were receptive to a similar type of messaging — to have bucket-list-type trips and moments, small or ambitious, while they forge on in their careers. From that insight, we developed the core takeaway of the Bucket List campaign: First Horizon can help you cross off your bucket list over time, rather than waiting until you retire to rush through your most long-awaited experiences.

We presented adcepts to the client, including mockups for social, print ads, banner ads, and mood boards, ending with custom illustrations. We injected variety and vividness into our concepts to appeal to younger consumers — the ones who weren’t retired, and who didn’t expect to retire. Scroll through our work below.

Bucket Listening.

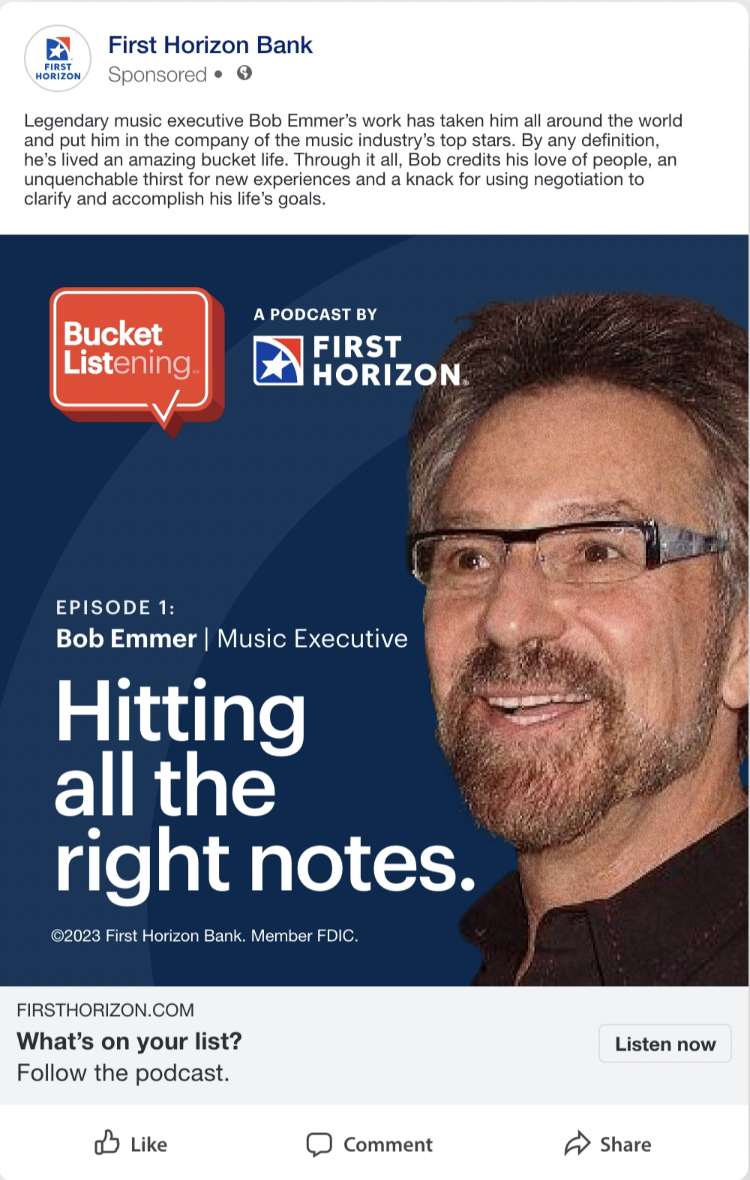

The client loved the work so much that they broadened the scope of the Bucket List campaign into a podcast called “Bucket Listening.” First Horizon considered each guest on the podcast to be their client, which created a situation that felt like we weren’t writing for a client so much as our client’s client. First Horizon supplied the images they wanted to run on social media. So the design was fairly templated. But the copy had to be, in their eyes, impeccably polished. The pressure that First Horizon exerted on the copy pushed us to focus and sharpen the writing. I conducted creative research and modeled the post copy off the episode captions in Netflix shows.

Except, instead of writing captions for a docuseries about Arnold Schwarzenegger, I was writing about the star quarterback for the Miami Dolphins, a baker who turned $5 into a cupcake empire, two businessmen who opened a hotel that employs students with intellectual disabilities. Check out our work below.

Outro

Own the moment.

The feedback we received for Bucket Listening was overwhelmingly positive. We snagged an AVA Gold Award for our work. But, more importantly, the client loved it. The project manager on our team scheduled our presentations on Friday afternoon, and the client said that they considered those calls to be relaxing segues into the weekend. Yet that comment might be applied to all the work we did for them in 2023, a challenging year for banks that saw First Horizon stay profitable and even grow while other regionals were folding around them. We were proud that, as First Horizon’s agency of record, our work helped them stride into the next year stronger than before.